The number of issues bedevilling colleges right now is staggering. But if we were to trace the issue where higher education lost the support of the public, it would be tuition. Think about all the conversations you have about college — don’t most of them begin with price? Who can afford college? Why has it gotten so expensive? How will I ever save enough to send my kids to college? “It’s outrageous these institutions have the audacity to charge so much for tuition and give so little to the city.”

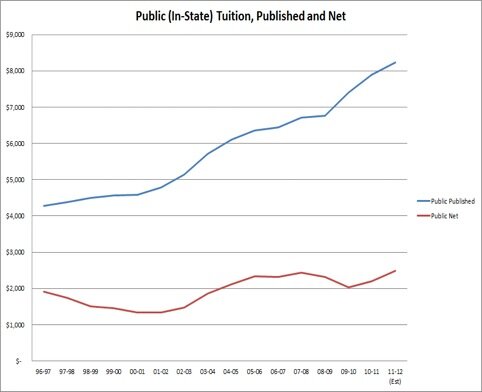

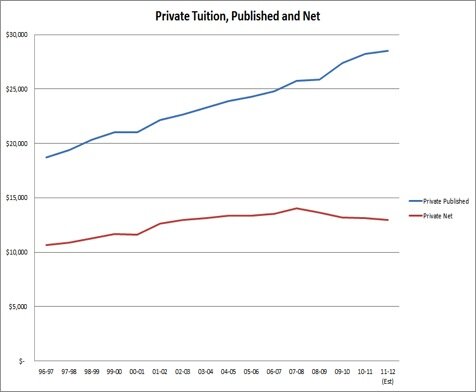

It seems that if colleges wanted to win back some public support, they might want to start with tuition. Many colleges would argue that it isn’t possible and articles have shown that at some colleges, the tuition price doesn’t even cover the cost of the education. But I don’t think colleges can win this argument. To see why, look at these charts — they show the sticker price and the net tuition collected by public universities, and private colleges and universities, respectively:

Source: College Board

Why are these charts so important? Because they show that while colleges have been jacking up prices at rates far exceeding inflation, the net proceeds have barely inched up.

In short, tuition is a shell game. Stephen Trachtenberg, who recently stepped down at as president at George Washington University, said he deliberately made it the most expensive university in the nation because “People equate price with the value of their education.” Every year that colleges have hiked tuitions, they have also increased the average discount they give to each student. The most recent survey showed the average discount for freshmen was 42.8 percent, the highest ever. And the average discount for all undergraduates is 37.2 percent, another record. At the current rate of increase the average discount will reach 50 percent soon, and college truly will be half-price.

Almost no one pays full price for college. So why do colleges keep attaching a sticker price that is alienating to so much of the public and politicians, and killing the dreams of young people?

A number of colleges, like Concordia-St. Paul have recently dropped their sticker price to more closely reflect the reality of what they are collecting in net tuition. But most of the colleges that have done so are small regional liberal-arts colleges that don’t have the influence to change the direction of the market leaders.

Meanwhile, Grinnell College, the fifth wealthiest national liberal arts college, recently surprised many by announcing that its current financial trajectory is unsustainable. Grinnell’s tuition-discount rate is a staggering 60 percent, and its own analysis predicts that the discount will increase to 70 percent within a decade.

Step back and think about that for a moment. Grinnell’s tuition for U.S. students this year is $41,004. But at a discount of 60 percent, it is actually only collecting about $16,401 per student. What other business could possibly ask for so much and collect so little, and stay in business?

Grinnell happens to have a $1.4 billion endowment, much larger than almost any college of its size. So it can afford this approach much more readily than other colleges and universities. But even a nest egg that large can’t last forever.

Here’s what we are left with: most colleges are in a perpetual half-price sale, but they say they can’t do anything about it because if they were to cut their price, they would no longer be competitive. Not only is the high-tuition, high discount approach a broken business model, it is a cruel and unnecessary business model.

Here’s why:

- More than half of students take colleges off their prospective list for price alone. They don’t know how much they will actually pay, they just know the sticker price, and the college that might offer them the best chance at success gets rubbed off the list.

- If colleges weren’t charging so much, the student debt crisis wouldn’t be as bad. We wouldn’t have outstanding student loans of more than $1 trillion because students wouldn’t have to borrow so much to go to college.

- And the colleges with the highest default rates, for-profit institutions, would not be able to charge as much either. They typically charge just a little less than their traditional counterparts, and since they don’t typically have any institutional aid to offer, their students must tap the loan market to pay their tuition. These students usually have lesser financial means than students in traditional higher ed– thus the higher default rate.

We can’t just decree that all colleges cut their tuition rates by one-third. We need to let colleges continue to compete. But essentially colleges are already treating their tuition as a myth. The business models of colleges are not built on sticker price — they are built on net tuition. As the graphics above show, most colleges could cut tuition by at least a third, and not damage their bottom lines one iota.

Wouldn’t that be a starting place for colleges to begin to build some good will with the public? Wouldn’t it begin to make college seem more attainable again? And isn’t that a better competitive place to be in for most colleges than straining to explain to angry customers why the laws of economics simply don’t exist when it comes to college tuition?

Incoming search terms:

- rates of college tuition

- Nest Egg to college tuition

- high tuition equals better colleges

- cost of college education (charts OR graphs)

- what college tuition will look like in the future

- us freeze college tuition growth through 2020

- who doesn\t think that college tuition is too high

- united states freeze public college tuition growth through 2020

- tutition issues in higher education

- why do you think college tuition has doubled